jersey city property tax rate 2020

The current total local sales tax rate in Jersey City NJ is 6625. 161115 2019 average taxes.

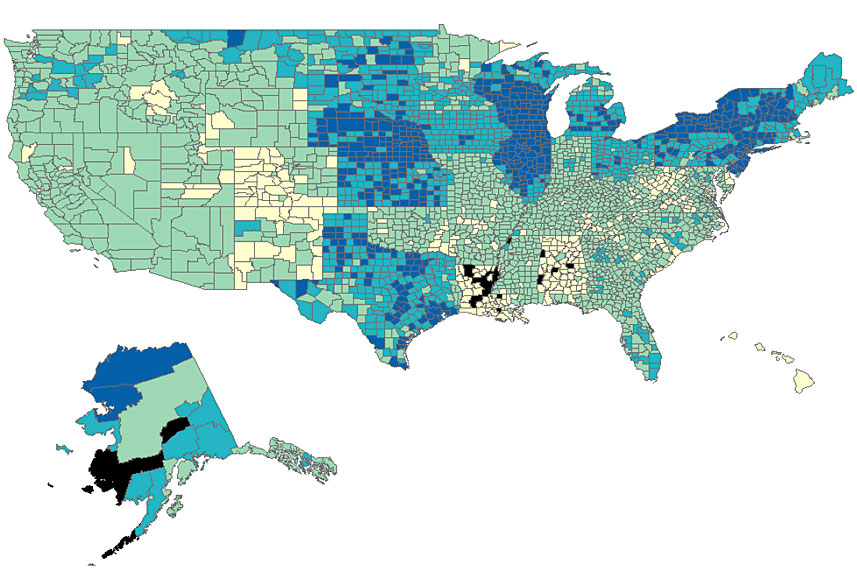

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

Cumberland 2020 average taxes.

. Overview of New Jersey Taxes. In Person - The Tax Collectors office is open 830 am. 2020 rates included for use while preparing your income tax deduction.

The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000. Average Property Tax Rates and Tax Bills for Each New Jersey County. This is the total of state county and city sales tax rates.

4192 2020 average residential property value. In 2020 and 2021 driven by the leadership of Superintendent Franklin Walker and under intense pressure from advocates with Jersey City Together the BOE raised the levy significantly. The average effective property tax rate in New Jersey is 242 compared with a national average of 107.

What is the Average Property Tax Rate in NJ. 2020-2022 Agendas Minutes and Ordinances. In fact rates in some areas are more than double the national average.

78 million of that amount is included in the 2021 budget compared to 28 million of federal COVID-19 in 2020. The average 2020 New Jersey property tax bill was 8893 an increase of. 6757 hqhudo 7d 5dwhiihfwlyh 7d 5dwh 8821 252 8821 35.

Jersey City NJ Sales Tax Rate. This rate includes any state county city and local sales taxes. County 2021 Average County Tax Rate 2021 Average County Tax Bill.

We had placed a call to the property tax administrator who had provided the updated rate of 161. Did South Dakota v. 78 million of that amount is included in the 2021 budget compared to 28 million of federal COVID-19 in.

The Average Effective Property Tax Rate in NJ is 274. 252 551721 252 05 252 51 252. Click table headers to sort.

City of Jersey City PO. 587 rows Vermont Property Taxes Rhode Island Real Estate Taxes Connecticut Property Tax. The December 2020 total local sales tax rate was.

3994 2019 average residential property value. 53 million in 2020 and 89 million in 2021. I can confirm that 161 is correct but much like yourself was only finding 148 online.

The average 2020 Hudson County property tax bill was 8353 an increase of 159 from 2019. On average the states property taxes rose 212 percent to 8953 between 2018 and 2019. Jersey City was allocated 146 million in total ARP aid.

Jersey City S Property Tax Rate Finalized At 1 48 Jersey Digs Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy. The data released this past week comes from the state Department of Community Affairs. The minimum combined 2022 sales tax rate for Jersey City New Jersey is.

Checking Account Debit - Download complete and send the automated clearing house ACH Tax Form to JC Tax Collector 280 Grove Street. The County sales tax rate is. The New Jersey sales tax rate is currently.

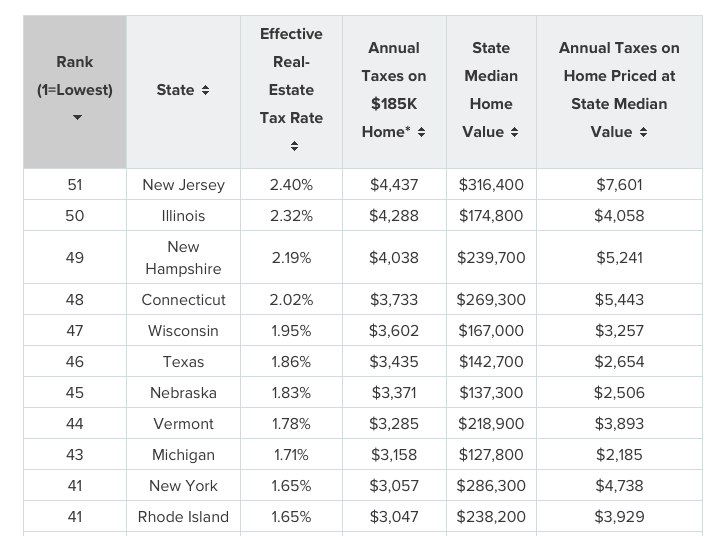

The average effective property tax rate in New Jersey is 240 which is significantly higher than the national average of 119. County Equalization Tables. Camden County has the highest property tax rate in NJ with an effective property tax rate of 391.

The Jersey City sales tax rate is. The average effective property tax rate in New Jersey is 242 compared to. The city of Jersey Village is looking to adopt a lower property tax rate for the 2020-21 fiscal year but one that will also raise more revenue.

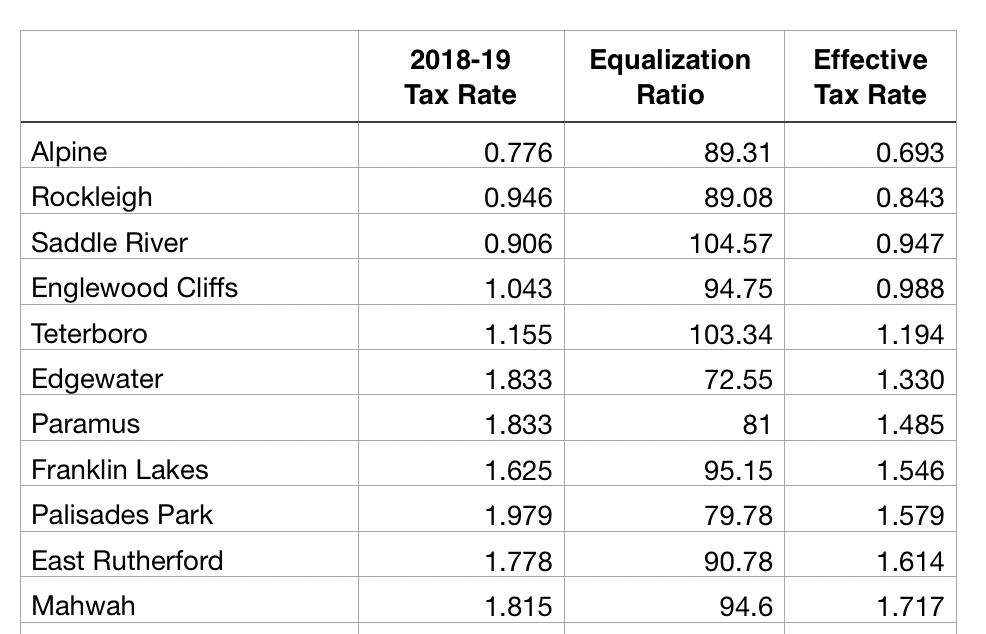

Homeowners in this Bergen County borough paid an average of 16904 in property taxes last year a 182 increase over 2018. Homeowners in New Jersey pay the highest property taxes of any state in the country. It was higher.

By Mail - Check or money order to. The latest sales tax rate for Jersey City NJ. It was lower than the 2 percent cap former Gov.

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future. New Hampshire Tax Rates Massachusetts Tax Rates. Box 2025 Jersey City NJ 07303.

The average effective property tax rate in New Jersey is 240 which is significantly higher than the national average of 119. Jersey city property tax rate 2020 Monday February 28 2022 Edit. Counties in New Jersey collect an average of 189 of a propertys assesed fair market value as property tax per year.

Select the Icons below to view the assessments in Adobe Acrobat or Microsoft Excel. The 148 number is from 2018 and even Jersey Citys own website hasnt been updated to reflect the change. New Jersey has one of the highest average property tax rates in the country with only states levying higher property taxes.

ARP aid expires in 2024. On average the states property taxes rose 1 percent from 8953 to 9112 between 2019 and 2020. Jersey Citys 148 property tax rate remains a bargain at least in the Garden State.

While Cape May County has the lowest property tax. Chris Christie put into effect in 2011. The median property tax in New Jersey is 657900 per year for a home worth the median value of 34830000.

I am a member of the JCT education team. Homeowners in New Jersey pay the highest property taxes of any state in the country.

2022 Property Taxes By State Report Propertyshark

Property Taxes By State In 2022 A Complete Rundown

Connecticut Ranked 48th For Property Taxes As State Deficits Threaten To Drive Them Higher Yankee Institute

Property Tax Comparison By State For Cross State Businesses

Property Taxes By State Embrace Higher Property Taxes

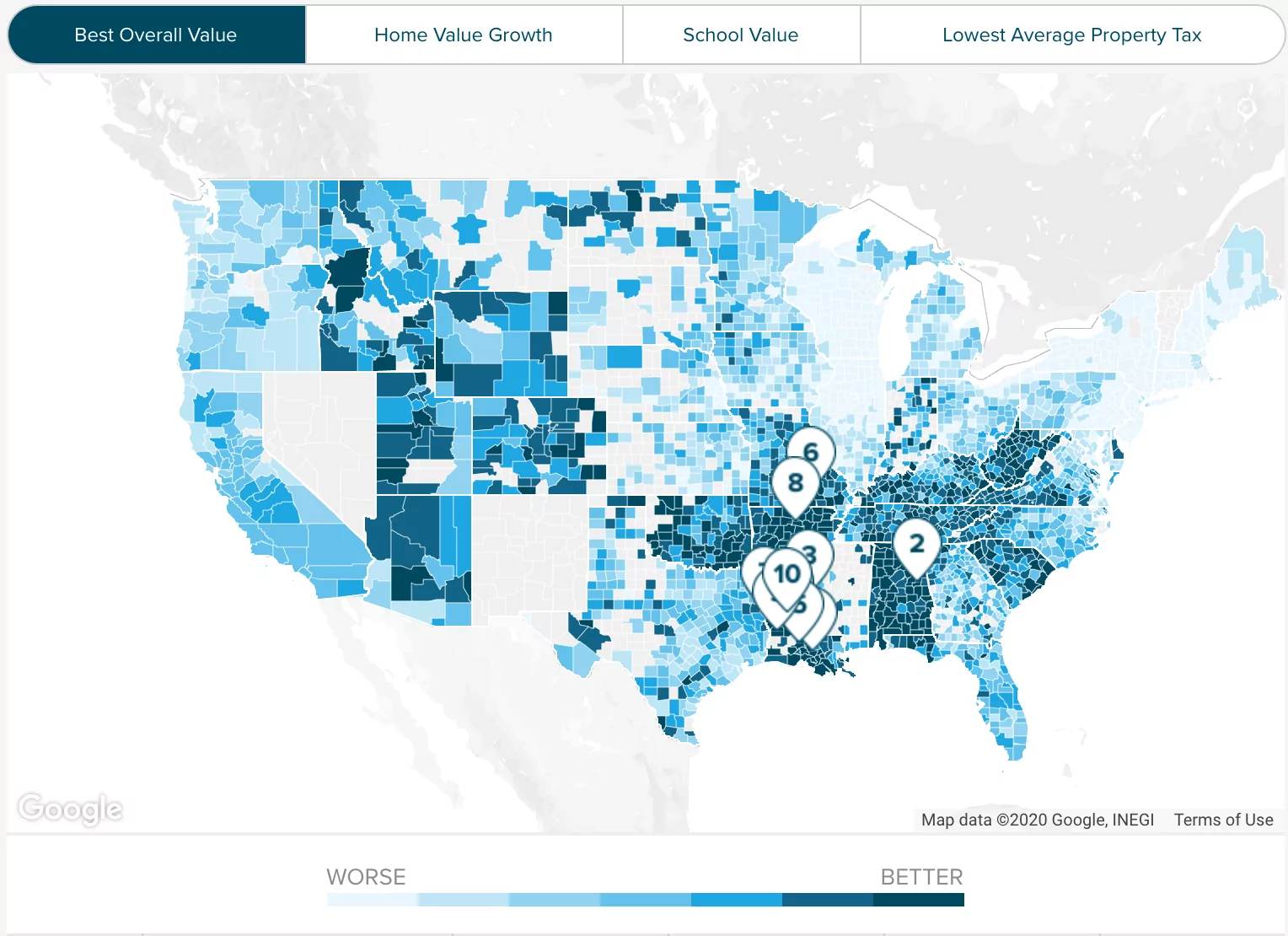

Property Taxes By State County Lowest Property Taxes In The Us Mapped

Freehold Township Sample Tax Bill And Explanation

Bergen County Tax Rates For 2018 2019 Michael Shetler

Property Tax How To Calculate Local Considerations

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future

Upstate Ny Has Some Of The Highest Property Tax Rates In The Nation

Illinois Now Has The Second Highest Property Taxes In The Nation Chicago Magazine

Local New York Property Taxes Ranked By Empire Center Empire Center For Public Policy

Property Taxes By State In 2022 A Complete Rundown

Loudoun County Va Property Tax Calculator Smartasset

New York Property Tax Calculator 2020 Empire Center For Public Policy

State Local Property Tax Collections Per Capita Tax Foundation

Where Do New Jersey S Property Tax Bills Hit The Hardest New Jersey Future